In Michigan, adding a teenager vehicle driver to your car no-fault policy might not cost you as high as it would in various other states A variety of prices are connected with having a teenage chauffeur in your family. Once they have their certificate, they require a lorry to drive (be it a moms and dad's lorry or one bought for them), they require money for gas, the automobile will need to be maintained regularly, and also, certainly, they must be guaranteed.

You may be amazed to find out that costs prices do not raise as a lot when teens are added to automobile insurance policies in Michigan, compared to some various other states. And, in the end, Michigan's auto no-fault PIP advantages are important in the unfortunate event of a severe Michigan cars and truck mishap.

Nationally, prices increased by 80 percent and also in some states, such as New Hampshire, insurance coverage costs increased by as long as 115 percent! The price the premium might raise additionally relies on the age and sex of the motorist; usually, it sets you back even more to insure more youthful, male drivers in contrast to older, women vehicle drivers (109% boost for a 16-year-old male driver vs. auto.

Be sure to call your insurance coverage agent straight to make use of any kind of price cuts that might put on your circumstance.

Auto Insurance Recommendations For New Michigan No ... for Dummies

Nothing else state in the nation requires motorists to acquire coverage that offers unlimited advantages this in spite of the truth that just a small portion of vehicle drivers will certainly ever before profit those advantages. Even the key objective of utilizing a no-fault system reducing suits and court sets you back no longer keeps in Michigan: (insurers).

If you've stayed in Michigan for a while, you know that budget friendly vehicle insurance coverage can be difficult to discover. It really feels like you have a much better opportunity of spotting Pressie, the monster serpent in Lake Superior, than you do locating a budget friendly insurance coverage that will not bust your budget. low-cost auto insurance. Michigan insurance costs and also policies have been under examination follow this link for years.

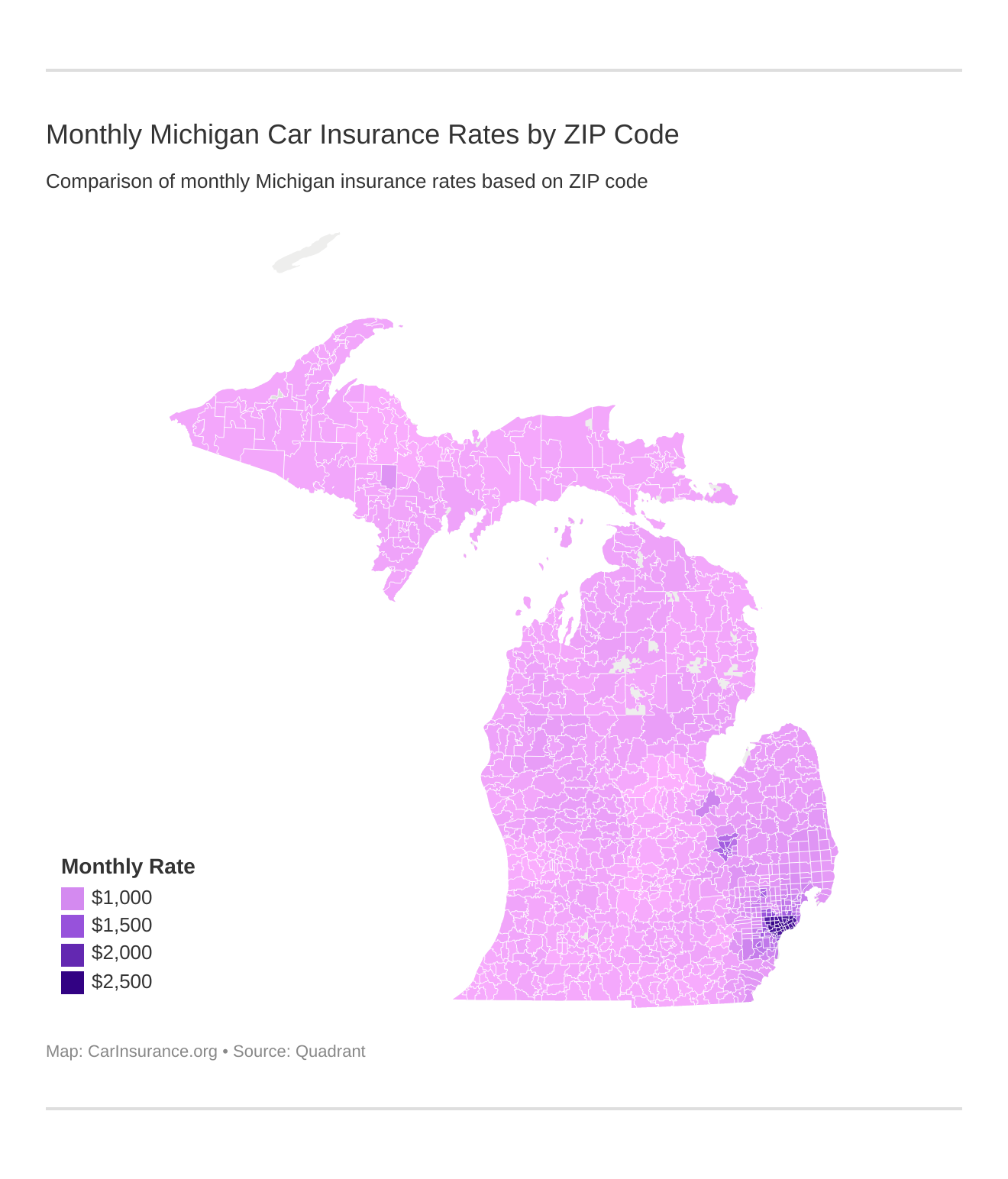

Despite the high prices of Michigan auto insurance coverage, there are methods to maintain your costs as reduced as feasible - car insurance. Maintain checking out to discover just how to find inexpensive automobile insurance coverage in Michigan. The ordinary price of Michigan car insurance policy is 165% higher than the national standard. No, this isn't an error.

Another research study located a somewhat reduced auto insurance rate in Michigan (generally, $2,309 per year for a full protection policy). Still, this rate is considerably greater than in neighboring states like Ohio, where the standard is $1,034 annually, and also Indiana, where full coverage insurance coverage prices, generally, $1,254 annually.

Not known Details About How Much Does Car Insurance Cost In Michigan?

You might be discouraged as a Michigan resident, however do not surrender! There are methods to reduce your vehicle insurance policy as well as find a plan that provides you a great deal of bang for your dollar. We can aid by strolling you via the process of comparing Michigan auto insurance prices estimate so you can get a affordable plan that helps you.

If you have a vehicle signed up in the state, you're called for to bring: insurance policy without optimum restriction: This spends for your treatment, shed earnings, and so on if you get hurt in a mishap. Property defense insurance (PPI) with a compulsory limit of $1 million: This spends for damage you cause to parked cars and trucks or other building however not lorries being driven.

Building damage liability: up to $10,000. You wouldn't have to utilize this coverage; however, if you strike an out-of-state motorist, or create a mishap in an additional state, this protection would come in useful. Due to the fact that Michigan car insurance policy is so costly, a great deal of individuals just don't get it.

For one, you'll enter lawful problem if you're captured. A conviction for driving uninsured can indicate approximately one year in prison, a fine of $200 to $500, or both. Your driver's license as well as registration may also be put on hold - cheap car insurance. Fees, prison time, and suspension aren't anything you want on your record if you eventually desire to minimize vehicle insurance coverage.

7 Simple Techniques For Less Than One-third Of Michigan Auto Insurance Refunds Sent ...

insure cars car insurance cheapauto cheap auto insurance insurance insured car

insure cars car insurance cheapauto cheap auto insurance insurance insured car

But that's not completion of it. If you get involved in an mishap while without insurance, you get on your own. You get no settlement for damages to your vehicle, damage to various other individuals's property, medical bills, or lost wages. Even if the other chauffeur was 100 percent at mistake, without insurance drivers aren't allowed to demand discomfort and suffering.

credit cheapest auto insurance vans cheaper auto insurancetrucks low cost cars insure

credit cheapest auto insurance vans cheaper auto insurancetrucks low cost cars insure

Furthermore, you are disqualified from all of the No-Fault benefits, and also are held economically responsible for the various other driver's No-Fault advantages! You might additionally be compelled to pay for the other person's lost earnings if they end up missing out on work due to the fact that of the accident.

That indicates it's an excellent concept to have (and also maintain) your insurance coverage in instance of a mishap that can require you to either payor advantage if you're insured. The secret is merely to discover a plan that benefits you and also that conserves you money by searching. It's a great deal less complicated (as well as smarter) to simply get insurance as opposed to managing the fines you'll face driving uninsured! See just how much you can save by comparing quotes through Below you'll locate a few hints on where to seek the cheapest automobile insurance coverage with lists of the most affordable deals typically for various sort of drivers.

These reviews show a blend of rate, top quality, as well as consumer complete satisfaction. Bear in mind, your details prices, as well as the very best Michigan cars and truck insurance coverage business for you, will differ based upon your driving history, where you live, what you drive, and what type of insurance protection you choose. affordable. Met, Life has over 145 years of experience in the insurance policy market (auto).

Getting My Best Cheap Car Insurance In Michigan 2022 – Forbes Advisor To Work

Modern has an A+ ranking with the BBB and several programs that allow you to make discount rates based on secure driving behaviors. Their Photo Program was one of the initial electronic tracking applications for motorists to earn discounts. This makes Progressive among the very best firms for risky motorists who desire an opportunity to make reduced prices.

Just enter your zip code listed below to get begun. If you reside in Michigan, having the option of cars and truck insurance coverage discount programs might be your only saving grace. In a state that costs chauffeurs 165% greater than the nationwide average to guarantee their cars, even the tiniest price cut can aid - cheap auto insurance.

Good Driver: You can get excellent vehicle driver discounts if you don't have recent tickets or crashes on your record. Take into consideration the truth that simply one speeding ticket can increase your insurance coverage prices by 49%, and it's clear that being a safe vehicle driver is in your ideal rate of interest.

Great Student: A pupil who brings a "B" standard or greater can get a discount between 5-20%. Usage-Based: Usage-based price cuts are given when chauffeurs mount electronic tools on their automobile that relay information to the insurance business. The info contains practices like rate, unexpected stopping, turning about, as well as various other activities.

How To Find Cheap Car Insurance In Michigan In 2022 Things To Know Before You Get This

If you stay in Michigan and also believe you certify for any one of these discount rates, ask your insurance coverage business about having them put on your monthly bill. It's also constantly a good concept to call your insurance provider regularly (at the very least yearly), to update them on your situation and establish if there are any type of new price cuts for which you may qualify - cheapest car.

insurers trucks cheap auto insurance car insuranceinsurance companies risks suvs insurers

insurers trucks cheap auto insurance car insuranceinsurance companies risks suvs insurers

Inspect out Contrast. com's extensive car costs failure to ensure you account for all the added charges you could be responsible for when acquiring a cars and truck in Michigan. If you are a Michigan homeowner, it is essential to bring the proper sort of insurance policy. Despite the fact that costs are particularly high, the expense of not having insurance is much greater.

You might also get on the hook for damages or injuries to various other people if you drive without insurance, which can drain you economically as well as create you to shed your permit till you are able to pay these prices. As a result of the implications and also already high rates of insurance policy, it's specifically vital to have access to a system that gives you price-saving choices. risks.

com is your finest bet for comparing various business in Michigan as well as identifying which inexpensive auto insurance coverage plan is the ideal choice for you. When you have accessibility to multiple carriers at your fingertips, it's much easier to browse for the most inexpensive choice - vehicle insurance. This, in addition to the prospective discount rates that we talked about earlier, might reduce some of the migraine (and also wallet-ache) caused by the high rates of a Michigan car insurance plan.

What Does Home, Auto And Business Insurance Coverage - Acuity Mean?

For any kind of questions about regulations and required insurance coverage, the Michigan Division of Insurance Policy and Financial Providers can supply assistance. Michigan requires PIP (injury security), PPI (home defense insurance coverage), bodily injury liability, and residential or commercial property damages obligation. This insurance policy covers you if you are associated with an accident with an out-of-state vehicle driver, in addition to if you harm any individual's building or wound an additional driver.

Auto insurance coverage is 165% more than the national standard in Michigan, with the ordinary annual expense performing at over $1800. In some areas, such as Detroit, the price of a policy can run over $5,000 each year. If you drive without insurance in Michigan, you can be penalized with prison time, rigid penalties, certificate suspension, and the obligation of paying the other vehicle driver's clinical expenses and other expenditures.

Furthermore, the Secretary of State will not prolong your enrollment up until you show proof of appropriate insurance. low cost auto. If you are discovered guilty of damages when it comes to a legal action when you drive uninsured, you are accountable for paying the problems off in complete, or you'll have your certificate suspended till you're able to do so.

Offered the already high price of Michigan automobile insurance, it's finest to simply keep your license, so you don't encounter a situation in which you are called for to look for vehicle insurance coverage without a permit (cheap).

Excitement About Detroit And Michigan Lead The Nation With The Highest Auto ...

You have lots of choices when it pertains to choosing a car insurance firm in Michigan. This listing is not comprehensive, so it is very important to do your very own research study and also access least 5 quotes from cars and truck insurance provider before choosing where to take your company. To get to this listing, we considered many factors.

It indicates the capacity of an insurance coverage business to pay claims. A poor or fair rating might show either a hesitation or an economic failure to pay claims. We investigated which vehicle insurer in Michigan had the best economic strength. All five vehicle insurer on this list had either an exceptional or exceptional monetary score, suggesting the economic wellness of the business - business insurance.

We compared the annual premiums of auto insurance companies in Michigan. cheapest. We did not assume the best automobile insurance coverage company supplied the least expensive rates.

We contrasted numerous various online insurance markets and also independent companies to find the ones that had consumers' benefits in mind. cheapest auto insurance.

Some Known Factual Statements About Auto Insurance - State Of Michigan

insure car insurance car insured affordableauto cheap cheap insured car

insure car insurance car insured affordableauto cheap cheap insured car

It likewise can be May before some residents get checks or automated deposits from their insurance coverage firms. The due date for automobile insurance providers to send out the cash to insurance policy holders with eligible vehicles is May 9, Whitmer's workplace claimed in a news launch.