liability car insured car cheap insurance

liability car insured car cheap insurance

Just keep in mind that looking around is always a necessity. While all insurance provider evaluate the exact same aspects when crafting quotes, those aspects aren't all weighed equal. Sources: This material is created and preserved by a third celebration, as well as imported onto this web page to aid individuals provide their e-mail addresses (cheaper car insurance).

Turning 18 years of ages is the begin of their adult years. You are eligible to vote, open your very own credit lines, and in many states, own a cars and truck. Whether you're purchasing car insurance coverage for the very first time or seeking a more affordable plan, automobile insurance for 18-year-olds can be expensive.

cheap auto insurance vehicle insurance cheap auto insurance cheapest car insurance

cheap auto insurance vehicle insurance cheap auto insurance cheapest car insurance

When you prepare to begin comparing automobile insurance for 18-year-old motorists, enter your zip code below or call our team at free of cost, tailored quotes 7 days a week.: What Is The Average Vehicle Insurance For 18-Year-Olds? Since 18-year-old drivers do not have much experience behind the wheel, these chauffeurs are thought about high-risk. cheaper car insurance.

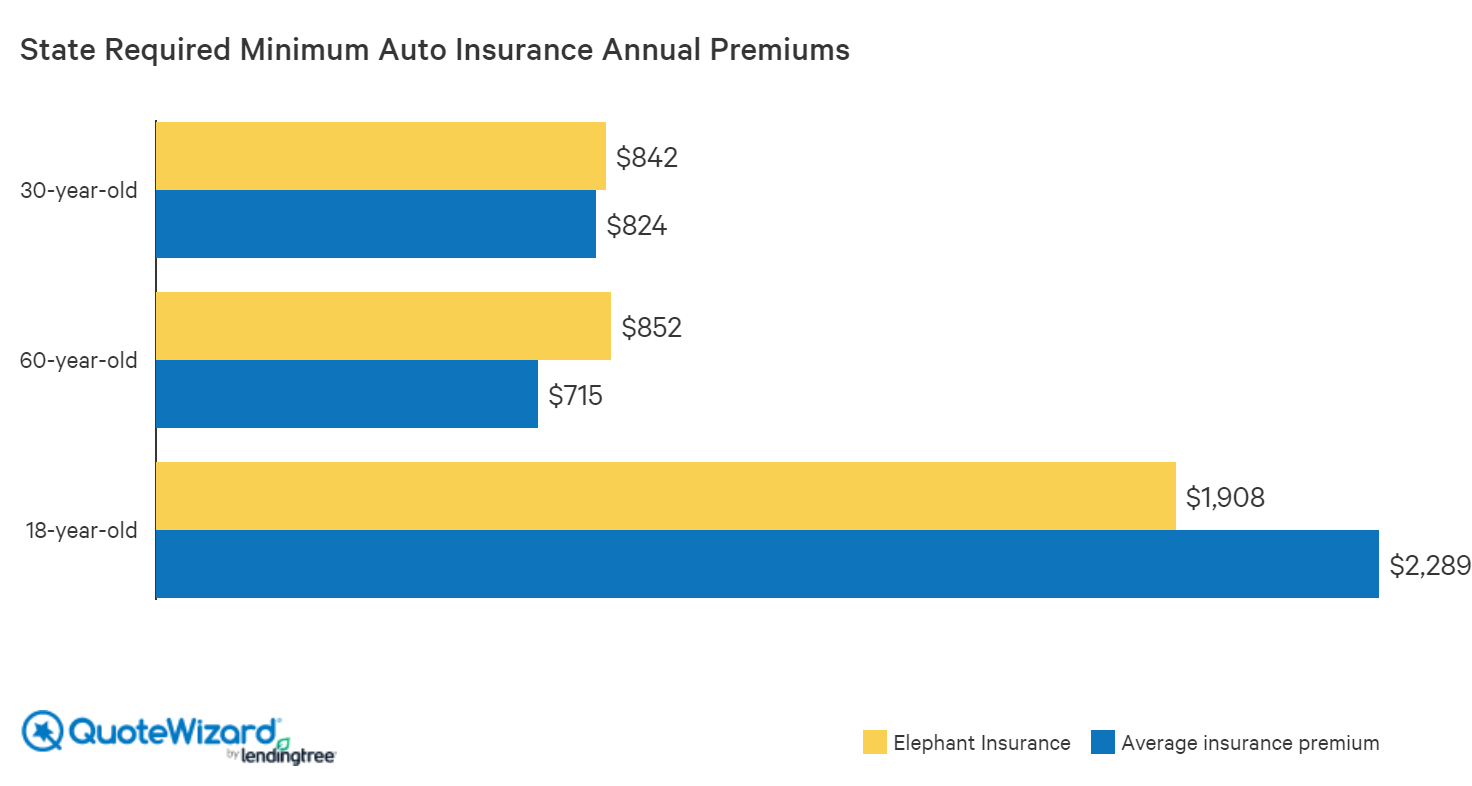

According to The Zebra's State of Vehicle Insurance policy research, the typical vehicle insurance coverage for 18-year-old vehicle drivers runs concerning $4,700 annually or nearly $400 per month (credit). The very same research discusses the cost savings 18-year-olds can see if they stay on their parents' insurance plan instead of starting their own it has to do with $2,600.

Even at 18, you are still thought about relatively inexperienced as well as much more in danger on the road to car insurance policy companies. This is Check out the post right here why the average auto insurance policy for an 18-year-old is more than someone who remains in their mid-twenties. Being an 18-year-old lady can mean lower car insurance prices contrasted to an 18-year-old-boy.

Car Insurance For 18-year-olds: Average Rates For Coverage - Questions

The less cases, accidents reported, or citations you've had, the much less of a threat you are attended the insurance provider. Mishaps happen, and also when they do, do not be distressed if you see your policy dramatically increase. If you remain in the market for the very best cars and truck for your young adult, you're probably thinking of 2 points: safety and security and price.

Taking into consideration just how much you can pay out-of-pocket for your young adult's cars and truck affects the price of your auto insurance costs. The restrictions and also deductibles you choose will establish how pricey your automobile insurance coverage rates are, so it is very important to look around for plans (insurance companies). How To Minimize Automobile Insurance Policy For An 18-Year-Old From discount rates to usage-based savings programs, there are several means for teens to save cash on auto insurance.

If you speed up and also brake securely, you can reduce car insurance policy. Usage-Based Cars And Truck Insurance Coverage For Teenage Drivers Usage-based programs can help you conserve cash on teen auto insurance coverage. When you think about just how pricey the typical car insurance coverage for 18-year-old chauffeurs is, taking the time to drive safely can have excellent rewards (money).

insure affordable auto insurance affordable auto insurance low-cost auto insurance

insure affordable auto insurance affordable auto insurance low-cost auto insurance

A few of the auto insurance coverage discounts you can get for 18-year-old chauffeurs include: Excellent student discount rate for maintaining a B standard or greater Driver training course price cut for completing pre-approved programs Far-off pupil discount rate for trainees who most likely to institution over 100 miles far from house without a cars and truck Recently independent discount rate for motorists that were formerly listed on their parents policies and also are currently opening their own New teenager benefits for consumers of over one year that are adding a teenager to their plan The Roadway Ahead Overview provides you general driving suggestions, tips on driving in hazardous weather condition conditions, and much more. auto.

Safeco uses a parent-teen agreement that outlines clear assumptions and guidelines for brand-new chauffeurs behind the wheel (auto insurance). Find out more in our full Safeco insurance policy review. In addition to Drive Safe & Save, State Farm likewise uses Avoid a special discount rate available to chauffeurs more youthful than 25. To get this price cut, you need to: Have a legitimate vehicle driver's certificate Have no at-fault mishaps or moving offenses during the past 3 years Full the program demands within 6 months of signing up Customers that sign up need to complete components regarding secure driving.

About Car Insurance For Teens And New Drivers - State Farm

Our research study discovered that these service providers have inexpensive rates and great insurance coverage for young drivers. The most effective method to understand that you're getting the most economical car insurance is to contrast quotes from numerous auto insurance provider side-by-side - insurance affordable. Enter your postal code in the quote box below or phone call to obtain started.

It is a recognized brand name that has been offering young adults as well as moms and dads with dependents considering that 1912, which has actually gained it a 4. Some of the protection benefits that are useful for young drivers are: This strategy will certainly shield your premium versus increased rates after your very first at-fault crash, which can be valuable for more recent drivers.

The typical 18-year-old chauffeur on a separate policy from their moms and dads pays $5,243 every year for complete protection auto insurance policy and also $1,652 yearly for minimal coverage, according to Bankrate's study of estimated annual premiums. credit score. On standard, vehicle insurance prices for 18-year-olds are much greater than the ordinary price of auto insurance in the nation overall.

Motorists between the ages of 16 and 19 are at a greater danger for being entailed in car accidents than any kind of other age. Additionally, data from the National Freeway Web Traffic Security Management (NHTSA) reveal that automobile crashes are the leading source of teenage fatalities in the nation, with over 2,000 young drivers in between ages 15 as well as 19 killed in 2018 alone.

It is necessary to keep in mind that insurance policy laws vary by state which there are states which outlaw making use of gender as a score aspect. In these states, males and females pay near to the exact same quantity for insurance if all various other variables are equivalent. Typical annual full insurance coverage premium Typical annual minimum coverage costs Male $5,646 $1,753 Female $4,839 $1,551 Most affordable car insurance policy firms for 18-year-olds, Among the easiest ways to save money on your auto insurance policy is to pick a business with low average premiums.

Getting My Car Insurance For 18 Year Olds - Average Insurance Costs To Work

We then evaluated the costs to find the business that use reduced typical automobile insurance rates for 18-year-olds. The average full protection costs for each of these firms is well below the national standard for 18-year-olds with full protection, which is $5,243 each year. The cheapest business on our checklist for full coverage insurance coverage is Erie, can be found in at just $2,950 per year.

In addition to those price cuts, you could conserve by paying completely, having an additional plan with Auto-Owners or registering for a paperless plan. Auto-Owners also receives a reduced grievance index from the National Association of Insurance Coverage Commissioners (NAIC). A score of 1. 00 indicates that the NAIC received an ordinary number of issues.

Nation Financial, Country Financial may not be as familiar to you as a few of the other companies on our checklist, but the company does supply average costs that are far much less than the national typical expense of auto insurance coverage for 18-year-olds. Nation Financial only sells insurance in 19 states, and if you are qualified for insurance coverage, you may wish to get a quote.

If you're an 18-year-old driver looking for ways to save on your vehicle insurance coverage, you may desire to look right into these pointers.

auto cheap car insurance companies car insured

auto cheap car insurance companies car insured

For this factor, lots of insurance policy providers award good qualities with a discount. cheapest auto insurance. You will likely just be qualified for this discount rate if you are a permanent pupil, and you will probably need to offer a copy of your latest quality card to prove that your qualities certify. Every insurer will have its own guidelines, but several providers need you to be below the age of 25 as well as maintain a GPA of at least 3.

The Cheapest Car Insurance For Teenagers In 2022 - Business ... - Questions

Nevertheless, this option is generally just offered if you are guaranteed on your moms and dads' policy - business insurance. Usually, you will certainly still be covered to drive when you are home on breaks, but you might intend to contact your company to identify its certain rules. Usage-based automobile insurance policy and also telematics price cuts, Numerous business are providing price cut programs that track your driving routines and also award you a customized price cut.

Generally, increasing your insurance deductible reduces your costs, because you are eager to pay more in the occasion of an insurance claim, which conserves the company money. You need to make certain you can pay for to pay the deductible if you do submit a claim. Make use of price cuts, The majority of insurance provider offer discounts, and also benefiting from as many as you can could help you conserve.

How to get the most effective insurance for 18-year-olds, Although you may be acquiring automobile insurance policy for the very first time as an 18 year old, finding the best coverage for you does not need to be a tough procedure. It does, nevertheless, need a bit of research study and understanding (cheaper). Before you buy insurance policy, it might help to: Car insurance coverage put together numerous protection kinds.

Just make sure you're getting quotes for the exact same protection types and restrictions from each company to compare prices properly. If you are entirely brand-new to purchasing vehicle insurance policy, talking to a representative could be practical.

Often asked questions, Should I get my own insurance coverage or remain on my moms and dads' plan? If you still live at home, you might have the ability to remain on your parents' vehicle insurance plan. Generally, this is going to be a much less expensive option. If you live on your own or own your car without a parent as a co-signer, you will typically need your own plan.

Car Insurance For Young Drivers - Compare The Market - Questions

Premiums often tend to peak for 18-year-olds and afterwards start to drop. Ordinary insurance coverage rates go down up until around age 70, when they can begin to slip up once more. Age and also sex aren't the only variables that influence your costs. Your selection of vehicle, the coverage kinds and also degrees you get, your driving background as well as the state you reside in will certainly all impact how much you pay.

Depending on age, vehicle drivers might be a renter or property owner. The list below states do not utilize sex as an identifying element in calculating costs: The golden state, Hawaii, Massachusetts, Michigan, Montana, North Carolina, Pennsylvania.